Duet Protocol Global Market Recap and Outlook — 20231113

Unlock the full potential of your trading strategy on pro.duet.finance! 🚀

Experience up to 100x leverage, dive into 30+ assets including FX, stocks, commodities, indices, and more, all in a highly liquid & smooth platform. Plus, enjoy the industry’s highest reward ratio with up to 80% trading fees returned to you! Hedge against crypto dumps and access traditional markets without leaving the crypto sphere. 💸📈💹

#TradeWithDuet #CryptoMeetsTraditional

Following Wall Street’s lead, most stock markets rallied, led by previous big blue chips while small caps/unprofitable stocks returned to weakness. US market sentiment and positioning data show the recovery process is still ongoing with room to go. China markets were relatively weak with latest data showing Chinese inflation falling back into deflationary territory. Crypto markets continued surging led by Ethereum and meme coins, but market breadth remains poor and ETF frenzy may be losing steam. Key events to watch this week include the APEC summit, US shutdown threat amid confrontation with China, and CPI data where focus remains on core inflation given the headline slowdown is a given due to base effects. If core stays slightly above 4% coupled with slowing growth in Q4, stagflation discussion may arise.

Poor 30Y Bond Auction: Thursday’s 30-year US bond auction performed poorly, with demand for the $24 billion of 30Y bonds below average levels. The bid-to-cover ratio was 2.24, below the prior 10 auctions’ average of 2.38. Subsequently, the 10Y yield spiked 11bps to 4.64%. The 30Y yield surged 15bps back to 4.8%, one of the biggest single-day jumps since June 2022. The 2Y yield returned above 5%, hitting new highs for November.

Earlier on Wednesday, the $40 billion 10Y bond sales statistics were also mediocre but decent given the increased auction size, so 10Y yields edged lower after the auction while short-end yields rose, steepening the inversion further in a sign investors are betting the hiking cycle is over. But the later 30Y auction drove long-end yields back up, mainly reflecting lingering concerns on long-term economic and fiscal stability. Overall these are headwinds for risk assets.

Cyber Attack: ICBC’s US branch suffered a ransomware attack which as a major US debt market participant meant transactions through ICBC were unable to settle amidst the incident. The timing coincided with focus on new bond supply and may have impacted auction results, though the Treasury hasn’t revealed details.

Demand and Pricing Issues: Some noted demand for the bonds has fallen with direct and indirect participation at multi-year lows. The auctions led to higher yields, meaning bonds were sold at lower prices. 30Y yields climbed 15bps.

Hawkish Powell Comments Also Drove Yields Higher: At a panel, Powell said the Fed does not believe it has done enough on high inflation and reminded markets it will continue hiking when necessary.

Italian Bond Auction: The poor US auction sentiment seemed to impact Italy’s bond auction later where the Treasury sold €10B of 30Y BTPs at a 5.05% yield, highest since July 2013, showing the global bond sentiment spillover.

US Shutdown Concerns: The US government faces potential shutdown if no spending deal is reached by Nov 17. House Speaker Kevin McCarthy unveiled a stopgap Republican spending measure Saturday but it was promptly opposed publicly by some bipartisan lawmakers.

Internal Republican splits are the big issue, with some calling for a “clean” CR through mid-January with no cuts to spending or conservative policy add-ons. However, hardline conservatives are pushing for a comprehensive strategy including spending cuts and border security policies. So McCarthy’s latest proposal still appears to dissatisfy both Democrats who see it as “complicated” and Republicans who view it as not conservative enough. With the deadline nearing, many voices in markets doubt whether new Speaker McCarthy can avoid a shutdown.

The vicious cycle of political fragmentation and expanding debt burden remains unhelpful for resolving deficit issues and keeps spurring market repricing that increases the debt burden.

Another Downgrade: Moody’s put the US government’s credit rating outlook to negative on Friday, raising the possibility of another debt downgrade. It highlighted fiscal risks from “absence of effective fiscal policy measures” to reduce spending or raise revenue, which would lift rates and borrowing costs absent action. With 2023 politics looking messy, major fixes may not emerge until 2025, so we expect limited repricing significantly higher in the near term. As the news came late Friday, impact should further play out this week but far below the market turmoil after the August S&P downgrade.

Moody’s is the last of big 3 agencies with the US at top rating. US debt market is considered safe haven given depth and liquidity, with nothing comparable currently, though crypto is a potential challenger.

Reversing Divergence in US Stocks

US stocks rose a second straight week, with the SPX closing above 4400 for the first time since Sept 20 on big tech strength leading the NDX to outperform the RUT by ~6%, the biggest margin in nearly 8 months.

Blowout Q3 Earnings

A great week for Big Tech (ex-Tesla)

Big caps/growth surging back:

Thus far with 92% of S&P 500 companies reported:

81% beat EPS estimates, above 5-year (77%) and 10-year (74%) averages. Would be highest since Q3 2021 (82%) if maintained.

Net income up 4.1% YoY, ending consecutive quarters of declines since Q3 2022.

61% beat revenue estimates, below 5-year (68%) and 10-year (64%) averages. Would be lowest since Q1 2020 (56%) if held.

Sales up 2.3% YoY, rising for 11th straight quarter.

S&P 500 PE is 18.0, below 5-year average (18.7) but above 10-year average (17.5).

Analysts forecast S&P 500 forward 12M return of 15.9%. Energy and consumer discretionary expected to rise most.

Recall earnings were expected near 0% growth entering reporting season, though future growth was marked down, especially Q4 from 8% to 3.2%:

Healthcare is dragging the big reduction in S&P 500 earnings outlook. Excluding the sector, 2024 EPS estimate is only down 0.4%. On individual stocks, mega tech earnings outlook remains resilient, propping up 2024 expectations. Ex-Magnificent 7, S&P 493 2024 estimate is -1.4%.

Additionally, Q3 earnings also reflected broad slowdowns in capex spending:

Capital expenditures and R&D spending were up just 5% YoY, far below H1’s 14% growth pace. This deceleration was driven by several tech giants. Apple, Amazon, and Meta cut total capex and R&D spend by 6%, 6%, and 15% respectively in Q3.

Firms continued reducing buybacks (down 9% YoY) but at a slower pace than H1 2022 (down 22% YoY).

In other markets:

Asset manager BlackRock registered an Ethereum trust, sparking speculation on an ETH ETF since BlackRock similarly registered a Bitcoin trust earlier this year one week before applying for a physical BTC ETF. ETH led crypto gains last week.As an alt allocation frontrunner, gold prices plunged 3% with yields rebounding late week.Geopol fears easing led to a third straight week of oil declines:

Meme coin frenzy continued brewing with exaggerated moves in a few names plus stablecoin inflows, allowing crypto ex-BTC+ETH to outperform despite poor breadth still. This momentum may cool absent broadening as crypto faces USD strength, rising yields, falling inflation expectations, strong growth slowdown expectations, easing geopol risks, meme coin mania cracks (e.g. GAS collapsing from 30 to 10), etc. New narratives needed to sustain this rally (left tail risks lack enough positive skew currently for us to shift from neutral to outright bullish on crypto this week, at least not an outright short):

Stablecoin inflows near $2B in past month (red line below):

Continued USD Bounce

Growing Excitement Around a Bitcoin ETF

BITO (futures-backed) trading volume hit a record 40M shares (US$750M) on Thursday. AUM has jumped 60% in a month to over US$1B. Also, BITO holdings are 24% of CME Nov futures open interest and 70% of Dec futures open interest. With CME futures open interest exceeding Binance’s last week (US$4.2B vs US$3.9B), it appears US equity buyers contributed at least half the growth.

After this, the SEC decision deadlines are Nov 17, then Jan 15 and Mar 15.

On Friday, Gensler seemed to indicate some compromise on crypto:

“There’s nothing about crypto that is incompatible with the securities laws. The aim of the securities laws is to protect your audience and the investing public, so that they get proper disclosures and people aren’t representing what they’re going to do with their funds…”

“If Tom or anyone else wants to enter this space, I’d say come within the remit of the law. Build that trust with investors that you’re doing what you say you’re going to do, that you make proper disclosures, and that you’re not mixing all these functions, trading with your customers, or using their crypto assets for your own purposes.”

Investors reacted with FTT token briefly more than doubling Friday, shooting above $5.

Research Shows Physical Bitcoin ETF May Underperform

Recent research found niche/specialized ETFs often underperform broad markets in the 5 years after launch, with risk-adjusted annualized returns around -6% on average.

This is because they often launch when investor enthusiasm for their underlying benchmark assets or respective investment themes are elevated. In turn, this implies the securities these ETFs invest in tend to be overvalued. Higher expense ratios of such ETFs erode returns. Retail-driven demand also favors specialized ETFs and these investors are more prone to holding incorrect expectations leading to positive feedback trading.

Whether this plays out in a potential approved physical bitcoin ETF remains to be seen, but investors should continue to be cognizant of these historical lessons.

Shifting Focus in Rate Markets

Despite most believing the Fed is done hiking, long-term yields keep rising/hovering highs, possibly reflecting a market focus shift from inflation to fiscal deficits since inflation expectations changed little post-Aug 10th (+4bp vs +40bp prior) and have fallen rapidly since late October.

With lower fiscal revenue now, Fed QT, and largest foreign holders also trimming allocations, there is reason to expect $1.7–1.8 trillion annual deficits to persist for years. Plus investors remain focused on the short-end Bills where Treasury keeps upping long-term issuance, further lifting term premiums which significantly increases debt servicing costs.

The US Treasury itself forecasts 2024 net issuance including Bills and Coupons at $2.4 trillion, total issuance at $4.2 trillion, and believes there is room for term premiums to rise further.

China Data

China October CPI fell back into deflationary territory with key domestic demand indicators showing weakest condition since the pandemic began, while factory deflation worsened, raising doubts on broad recovery prospects:

Oct CPI slowed to -0.2% YoY from 0.0% in Sept

Oct CPI fell -0.1% MoM vs +0.2% in Sept

Oct PPI slowed to -2.6% YoY from -2.5% in Sept

Core CPI ex food & fuel eased to 0.6% in Oct from 0.8% in Sept

October China imports rose 3% YoY, first growth in 8 months, breaking downtrend expectations. Meanwhile exports plunged 6.4% YoY, far below the -3% forecast. This marks 6 straight months of export declines, disappointing markets.

Markets had expected exports to rebound on global supply chain recovery, but the data underscores most developed economies face near-term mild recession or weak GDP growth reflected in falling foreign goods demand.

Lending Survey

According to the Fed’s Senior Loan Officer Opinion Survey (SLOOS), US bank lending standards tightened further in Q3 but at a slower pace amid soft loan demand.

Goldman analysis shows when the SLOOS survey indicates banks acting more cautiously in lending, it tends to precede actual loan declines, which often leads to economic recession.

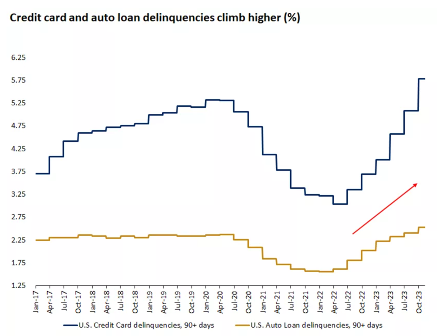

Additionally, total consumer credit card debt rose. As of Q3 2023, total US credit card debt exceeded $1 trillion, a record high (left chart). With rising household credit card balances, delinquencies also increased in cards and auto loans, surpassing even pandemic peaks (right chart):

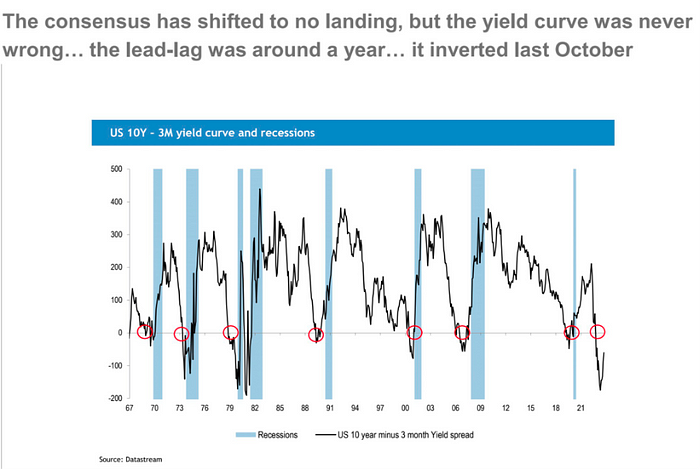

Yield Curve Inversion

Recessions have followed yield curve inversions in the past 50 years without fail:

However, limitations exist in using the yield curve to predict recessions and market performance since post-inversion stock market performance shows both positives and negatives with wide variance in timing and magnitude.

The high inflation into stagflation of 1979–1982 has similarities to today with 10Y-2Y deeply negative for years, confusing investors and markets, much like today. It inverted in 1979 and markets fell twice with months after breaking inversion. Before the 1981–82 bear market and worst recession post-WW2, the curve inverted and re-inverted at least 3 times with two 10%+ corrections in between. We just experienced the first re-inversion in October.

Positioning and Fund Flows

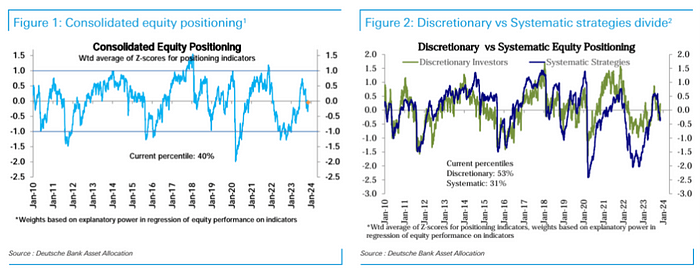

Goldman Prime data: Total US equity leverage rose to 99th historical percentile, though net leverage not extreme yet. Short cover willingness paused as longs added actively.

Overall equity positioning rebounded to neutral with subjective PM positioning recovering from below neutral to mildly overweight. Systematic positioning also edged up but still mildly underweight.

CTA equity exposure rose slightly last week but still relatively low by historical standards (6th percentile).

Supported by debt and equity bounce, equity funds saw strong inflows of $9B this week, first in over a month. US inflows ($11B) rose to 6-week highs.

Bond fund inflows ($11B) also accelerated to 4-month highs. Money market funds took in largest weekly inflows ($77.7B) in 7 months. High yield bonds ($6.3B) saw biggest weekly inflow since June 2020, reflecting increased investor appetite for higher risk.

Market Sentiment

Consistent with positioning data in showing ongoing but incomplete recovery process:

AAII bearish percentage plunged dramatically:

Key Events to Watch

APEC Summit (amid shutdown threat and US-China tension)

Wednesday’s Biden-Xi meeting is a complex event covering geopolitics, economics, and human rights. Expectations are low for major breakthroughs, with focus likely on improving communication and resolving some specific issues like fentanyl. US aims to maintain economic influence in the region while China seeks to repair and strengthen economic ties amid recent challenges. Additionally, we may see a series of high-level US-China business and investor engagements this week aimed at signaling commercial openness, with Xi hosting US executives for a dinner speech which could be positive for sentiment.

Inflation Data

Headline CPI forecast at just 0.1% MoM vs 0.4% in Sept, 3.3% YoY vs 3.7% prior. Core CPI expected at 0.3% MoM, 4.1% YoY, unchanged from September. CPI has largely met expectations over past few months. Downward price momentum in energy likely the biggest driver, while market watches for rental and OER deceleration. As before, services inflation will be the core support even as goods disinflation continues.

We believe the focus will remain on core with risk of stagflation discussion if it persists slightly above 4% coupled with significantly slowing growth in Q4. GDP Now currently forecasts Q4 at just +2.1%, tied for lowest in 5 quarters.

Institutional Views

Goldman published its 2024 global economic outlook, with main views including:

Global growth will remain resilient in 2024, DM inflation will continue falling. Goldman expects 2024 global growth of 2.6% (annual average pace) with US growth possibly leading DM again. Apart from BOJ, most DM central banks complete hiking but pause through H1 2024.

US growth leadership persists. While US real income growth drops from 4% in 2023 to 2.75% in 2024, it should support at least 2% consumption and GDP growth. Eurozone growth seen at 0.9% in 2024 but near-term weakness may continue amid fiscal risks like Italy.

Key challenge for investors is optimistic macro outlook is largely priced in. Meanwhile asset risk premia are compressed with valuations not cheap. Thus compared to heavy cash allocation this year, asset allocation should be more balanced in 2024 since each offers protection against at least one major tail risk.

Low R-star era is over. 2024 should cement the global economy has moved past the post-GFC paradigm of low inflation, zero policy rates, and negative real yields. While the transition remains bumpy, expected real yields have turned positive for most assets again and capturing higher yields is crucial for portfolio construction.

While still an overall constructive global backdrop, some dark sides exist. Key risks to watch include EM sovereign stresses from higher rate environment, intensified Eurozone sovereign pressures, challenges to currency policy trade-offs in China & Japan, and geopolitical tensions.

The report outlined several ways to increase portfolio yields:

Increase duration risk. Current higher yields provide greater buffer while bonds also regain appeal as hedges with yields already repriced.

Invest in cyclical sectors like energy. Their earnings yields are more attractive in a benign growth environment.

While cash yields still set high hurdles and US equity yields may be constrained by tighter valuations, EM and credit are also worth considering, especially if disinflation exceeds expectations allowing earlier central bank easing.

Unlike heavy cash allocation this year, maintaining balanced asset allocation in 2024 is crucial. Bonds hedge recession risk, commodities like energy benefit if global growth exceeds expectations, stocks and EM assets do well if disinflation allows earlier easing.

Morgan Stanley’s 2024 economic and market outlook also expects:

DM growth below trend and bifurcation in EMs. Slowing global growth with most DMs avoiding recession.

Fed and other central banks keep policy rates steady in H1, only slowly easing in H2. BOJ moves towards policy normalization.

Many asset prices already reflect optimistic macro expectations priced to perfection with little room for error. US assets look best while EMs face greater challenges.

Declining yields provide opportunity for “yield extraction”. Govt bonds, IG, etc can offer 6%+ yields.

Cautious overall stance on equities due to earnings recession, prefer defensive stocks.

2024 backdrop remains challenging but unlike 2023 requires careful strategies not just risk-on.

Similarities to Goldman:

Both expect DM growth below trend and slowing global growth.

Both see inflation peaking but gradual cool down and gradual central bank easing.

Both favor fixed income for higher yields.

Both like Japanese equities.

Differences:

Goldman more positive on EM versus Morgan cautioning greater challenges.

Goldman more optimistic on equity markets while Morgan relatively cautious.

Goldman sees EM potential while Morgan sees EM risks mainly from China deleveraging drag.

The End.

Unlock the full potential of your trading strategy on pro.duet.finance! 🚀

Experience up to 100x leverage, dive into 30+ assets including FX, stocks, commodities, indices, and more, all in a highly liquid & smooth platform. Plus, enjoy the industry’s highest reward ratio with up to 80% trading fees returned to you! Hedge against crypto dumps and access traditional markets without leaving the crypto sphere. 💸📈💹

#TradeWithDuet #CryptoMeetsTraditional

The End.

Join us:

Github| Medium| Telegram| Twitter | Website |Discord | YouTube