Duet Protocol Global Market Recap and Outlook — 20230925

Market Overview

Stock and Bond Market

Amid the Federal Reserve’s firm stance, surging government bond yields, and an imminent government shutdown, such risks have intensified investor panic, casting a shadow over the prospects of the U.S. stock market.

The S&P 500 Index (SPX) fell 2.9% last week, but it still retains a rise of 12.8% for the year. To give back all of its gains from 2023, it has a long way to go. The Nasdaq 100 Index fell nearly 3.5%, and the Russell 2000 performed even worse, dropping almost 4%.

The sectors that suffered the most were non-essential consumer goods and real estate, with healthcare and utilities experiencing smaller declines.

Cyclical sectors continued to underperform defensive ones.

Both the S&P 500 and Nasdaq 100 have fallen more than 6% from their highs at the end of July. The past week was especially unsettling for investors, marking the worst week since the collapse of Silicon Valley Bank on March 10. This is mainly because the Federal Reserve is expected to keep interest rates high for longer than anticipated, triggering a sell-off in U.S. stocks and bonds.

EPFR data shows that investors are selling global stocks at the fastest pace this year. As of last Wednesday, there was a net sale of $16.9 billion in stocks during the week, while investors bought $2.5 billion in bonds, marking 26 consecutive weeks of inflows.

European stocks have seen 28 consecutive weeks of outflows, with investors losing $3.1 billion in the past week.

With soaring oil prices, energy stocks recorded their largest weekly inflow since March, totaling $600 million.

Investors also withdrew $300 million from gold and $43 billion from money market funds. So far this year, investors have put $1 trillion in cash into money market funds.

At the same time, they have invested $147 billion in U.S. government bonds so far this year.

The yield on the U.S. 10-year Treasury bond is moving inversely to its price and is approaching a 16-year high. High bond yields offer attractive investment returns to investors, which are seen as virtually risk-free, undermining the appeal of stocks. The yield spread between 2-year and 10-year Treasuries has eased, hitting its lowest level since May last week, mainly due to higher long-term yields.

The more hawkish Federal Reserve was the biggest driver in the market last week. Other market risks include high oil prices, the resumption of student loan payments in October, a surge in worker strikes, and the potential for a government shutdown if Congress cannot pass a budget by September 30.

Seasonal factors are also a headwind. According to U.S. bank statistics, as of September 18, the S&P 500 historically falls 1.66% when it underperforms the average in the first 10 days of the month, and this year is no exception. Seasonal factors indicate that the stock market may experience a significant slide in the early days of October. However, this could also offer buying opportunities, as historical data also shows that in 9 out of 10 cases where the SPX has fallen by at least 1% in both August and September over the past 70 years, it has risen in October.

If the S&P 500 falls to 4200 points (about 3% below the current level), the price-to-earnings ratio would be 17.5, in line with the 10-year average, which could attract buyers.

On the technical side, the SPX broke below the 100-day moving average at 4380 points last Thursday and fell below the 23.6% Fibonacci retracement level. However, it’s still above the 200-day moving average at 4191 points. The 200-day moving average coincides with the 38.2% retracement of the bounce since the end of last year, making the 4200 line a strong technical support. Given that the economy hasn’t shown any danger signals, a continuous steep decline seems unlikely, and short-term consolidation is more probable.

The sharp drop in the market after this FOMC decision is consistent with historical patterns. In 10 of the past 14 meetings, the market has fallen an average of 1% the day after the meeting. The market usually oscillates in the following week, failing to fully recover the initial decline.

Historically, during SPX corrections of more than 5%, the average decline from the peak is 8–10% over a period of 4 weeks. The current correction (38 days) has already exceeded the historical average, but the decline hasn’t reached it yet.

● The decline in small caps may signal slowing growth expectations.

The small-cap Russell 2000 Index has fallen more than 11% from its closing high on July 31, roughly double the decline of the S&P 500 over the same period. The S&P 500 Industrial Index peaked on August 1 and has since fallen about 8%. Small-cap and industrial stocks typically plunge when the economy goes into recession.

These companies have historically bottomed out before the broader market. They are closely tied to the domestic economy and often don’t have as diverse a business scope as their larger counterparts, making them riskier bets in uncertain economic times.

U.S. small-cap and industrial stocks are declining, which is usually a sign of economic recession. However, with the stock market outperforming expectations for a year, some investors temporarily see these trends as just noise.

Bloomberg survey data indicates that the market expects corporate profits to decline by only 1.1% in the third quarter, followed by positive earnings next year.

● Breaking Wall Street’s Expectations

The S&P 500 index closed last week at 4321 points, exceeding Wall Street’s average expectation of 4366 points for the index in 2023. Analysts were largely bearish during the first six months of the year. However, with a series of better-than-expected data, they have been steadily raising their year-end forecasts for U.S. stocks in the past two months. Moreover, compared to interest rates, investors are more focused on the recovery of corporate profits. This has not only been one of the main driving forces behind the past rise of the U.S. stock market but is also a key factor for future growth.

● Chinese Stock Market Fights Back

Due to the U.S. and China announcing the establishment of bilateral economic and financial working groups on the 22nd, and both sides using similar wording, it indicates positive signs in U.S.-China relations. Mainland Chinese, Hong Kong, and U.S.-listed Chinese concept stocks all rose sharply.

The announcement stated that under the guidance of U.S. Treasury Secretary Janet Yellen and Chinese Deputy Prime Minister He Lifeng, the U.S. and China have separately established economic and financial working groups. These groups will provide ongoing structured channels for frank and substantive discussions on economic and financial policy issues, and exchange information on macroeconomic and financial developments.

The establishment of these two organizations also marks the first regular economic dialogue between the two countries since the Trump administration abandoned structured contacts in 2018.

A key milestone for potential positive progress is whether the Chinese President will attend the Asia-Pacific Leaders’ Summit (APEC) held in San Francisco in November. Given the current tensions between the two parties and the fact that the APEC meeting is held in San Francisco, it’s seen as U.S. home-field diplomacy. If China’s top leader attends the summit in the U.S., it may give the impression of “paying respects”, which is not what China wants, emphasizing an equal stance with the U.S.

● Has the Stock-Bond Correlation Bottomed Out?

Stock-bond correlation has become extremely negative (i.e., as interest rates rise, the stock market falls). This correlation has reached historical lows, and a reversal is typically expected at this point.

Foreign Exchange Market

The U.S. dollar rose for the tenth consecutive week, with the DXY up 0.3% to 105.6. Although the rate has only returned to the level seen last November, it is the longest continuous rise in nearly a decade.

After the Bank of Japan maintained its ultra-loose monetary policy, the yen fell, with USDJPY reaching a near 11-month high of 148.46. The Bank of Japan also pledged to increase stimulus without hesitation if necessary, further justifying the shorting of the yen. However, as the exchange rate approaches the 150 mark, there are speculations that the Japanese government may intervene to support the yen. Japanese Finance Minister Suzuki Toshimitsu warned on Friday that he would not rule out any options and warned that selling the yen would hurt the trade-dependent economy. (But we think devaluation is also importing inflation, which the BOJ longs for.)

The rapid pace of price growth in the UK unexpectedly slowed, and the Bank of England halted rate hikes, with GBPUSD refreshing a six-month low of 1.22305 last week.

The Canadian dollar strengthened against the U.S. dollar last week due to rising oil prices and expectations of further interest rate hikes by the Bank of Canada. Data shows that Canada’s annual inflation rate jumped to 4.0% in August from 3.3% in July due to rising gasoline prices.

Despite interventions by the People’s Bank of China, the yuan weakened slightly last week, moving from 7.27 to 7.29, breaking through the 7.3 mark on Thursday. One could imagine that without intervention, the USDCNY might be even higher. However, a positive sign was the significant rise in the Chinese stock market on Friday, with the CNY rebounding in response to optimistic sentiments.

Commodities and Cryptocurrencies

Despite Russia announcing a temporary ban on the export of gasoline and diesel, tightening the already tense global fuel market, hawkish signals from the Federal Reserve temporarily cooled the rise of oil prices. After reaching its highest level this year, the price of crude oil saw its first weekly decline in a month, but the drop was minimal. Overall, the spot market still shows signs of tightness, with U.S. inventories declining again (rising only three times in the past 12 weeks). Gold was also impacted by the Fed but showed resilience, remaining almost flat for the week.

Cryptocurrencies experienced significant fluctuations last week. At the beginning of the week, prices rose but plummeted over the weekend. BTC fell by 0.9% over seven days, Ethereum fell by 2.4%, and BTC dominance slightly rose from 48.9% to 49.1%.

Over the past month, Ethereum has fallen by 5%, while BTC remained almost unchanged. One reason for Ethereum’s underperformance may be its re-entry into an inflationary state. ETH network fees plummeted by over 9% last week to 22.1 million U.S. dollars, the lowest in nine months. Data from Ultrasound.money indicates that the supply of ETH is increasing because the number of tokens burned (destroyed) for transaction validation is less than the number of tokens created. Some analysts believe that the extensive use of Layer 2 solutions has reduced congestion on the Ethereum mainnet. Matrixport reiterated its negative outlook for crypto assets outside of BTC in its analysis on Friday, citing “astonishingly low earnings” and “lack of market attention” surrounding the next protocol update. The firm earlier this month predicted that if this trend continues, ETH might drop to 1000 U.S. dollars.

Over the past 30 days, the top 100 tokens in terms of market cap have shown the following gains:

Despite XRP and Grayscale defeating the SEC and witnessing some fund companies submitting new Bitcoin and Ethereum spot ETF filings, investors withdrew nearly 500 million U.S. dollars from publicly traded cryptocurrency products in the past nine weeks. According to CoinShares’ weekly report, publicly traded cryptocurrency products experienced a total outflow of 54 million U.S. dollars last week, marking the fifth consecutive week of sales.

Miller Tabak + Co.’s Chief Market Strategist Matt Maley stated in a report: “Many investors are concerned that the cryptocurrency market has received some good news in recent months, which hasn’t helped Bitcoin and other currencies rise… As institutional investors look for asset classes that can help them perform in the last three or four months of the year, they will no longer consider cryptocurrencies.

Hot news events

[Fed Bowman hints she supports more than one interest rate hike, Daly says not ready to declare victory against inflation]

Federal Reserve Governor Michelle Bowman said she favors raising interest rates again, and possibly more than once, a sign she will act more aggressively than her Fed colleagues to curb inflation.

“I continue to expect that further rate hikes may be needed to return inflation to 2% in a timely manner,” Bowman said on Friday, using hikes to describe her interest rate expectations.

“I see ongoing risks that energy prices could rise further and reverse the inflation progress of recent months,” she said.

Fed governors also noted that the impact of monetary policy on lending appears to be smaller than expected.

She said: “Despite the tightening of bank lending standards, we have yet to see signs of a significant contraction in credit, leading to a significant slowdown in economic activity.

Bowman’s comments suggest she may have made her highest forecast for rates in 2024, when one official predicted the federal funds rate would be between 6% and 6.25%.

San Francisco Fed President Daly said on Friday she wasn’t ready to declare victory in the fight against inflation, saying that until people are more confident that inflation is returning to price stability, “we won’t be satisfied with where we need to be.”

[Morgan Stanley: The Federal Reserve has completed raising interest rates]

Ellen Zentner, chief U.S. economist at Morgan Stanley, said: Cooling inflation should keep central banks on hold until they are ready to cut interest rates next year. In the short term, Republicans could lead to a government shutdown, which would strengthen the case for the Fed to maintain the status quo at its November meeting. She explained that a government shutdown would deprive policymakers of all the economic data they need to make decisions.

In order for the Fed to continue raising interest rates in November and December, two conditions need to be met.

The first condition is that the Fed is comfortable with more labor market loosening and slower job growth. The Fed mentioned this in its statement. The three-month moving average of job growth is about 150,000. If this number starts to accelerate again, then the trend of slower job growth looks unsustainable.

The second condition is that core services inflation (excluding the price of durable consumer goods, which continues to be in a deflationary state, and accounts for only 25% of the core inflation bucket) has also accelerated again. Services inflation is the most important part here. In order for core services inflation to accelerate again, it would need to rise significantly by about 0.6 percentage points, which is somewhat difficult.

“The Fed forecasts that real interest rates will rise further from around 1.9% at the end of this year to 2.5% next year. If you plug this into any macro model, you will find that the Fed does not really want to achieve a soft landing.” Or it can be speculated that the Fed will soon Disagreements arise.

[Ackman reiterates bond shorts, bond forecast 30Y should be 5.5%]

Bill Ackman remains short on bonds and expects long-term rates to rise further as government debt rises, energy prices rise and the cost of switching to green electricity increases.

“The long-term inflation rate plus the real interest rate plus the term premium suggests that 5.5% is the appropriate yield for the 30-year Treasury bond,” said Ackman, founder of Pershing Square Capital Management.

The current 30-year Treasury bond yield is 4.58%, hitting the highest level since 2011 last week. In early August, he publicly stated that he was shorting 30-period Treasury bonds. At that time, the yield was only about 4.1%. Judging from the futures price, it was 122 on August 1 and 117 on September 22.

Ackman added that with the economy outperforming expectations and infrastructure spending supporting growth and debt supply, expectations for a recession have extended beyond 2024 and inflation is unlikely to fall back as much as the Fed chairman hopes.

“No matter how many times Chairman Powell reiterates his goal, long-term inflation will not return to 2%.” “In the aftermath of the financial crisis, in a world very different from the one we live in now, that number was arbitrarily set at 2%.”

[Thailand’s Prime Minister said he expects Tesla, Google and Microsoft to invest US$5 billion]

Prime Minister Srettha Thavisin said on Sunday that Thailand expected to receive at least $5 billion in investment from Tesla (TSLA.O), Google (GOOGL.O) and Microsoft (MSFT.O).

“Tesla will be looking at electric vehicle manufacturing facilities and Microsoft and Google are looking at data centers,” he said, without elaborating on whether the $5 billion is expected to be a joint investment or each company’s investment alone. He also held talks with the company’s executives earlier last week.

[The United States says it cannot exclude China from the critical mineral supply chain]

U.S. Under Secretary of State for Economic Growth and Environment Jose Fernandez said on Friday that the United States cannot exclude China from critical mineral supply chains even as it seeks to diversify its sources of raw materials for products ranging from electric vehicle batteries to solar panels. outside.

He said China plays a key role in the processing of raw minerals, which means it will remain an important partner for the United States, especially since these minerals are an important component of electric vehicle batteries. Wider use of electric vehicles is a core tenet of the government’s climate change efforts.

Why is the fight for ‘critical minerals’ heating up?

Although many critical minerals are abundant worldwide, extracting and refining them into usable forms can be costly, technically difficult, energy-intensive, and polluting. China dominates the entire value chain for many of these products, accounting for more than half of global production of battery metals, including lithium, cobalt and manganese, and nearly 100% of rare earth production.

Approximately 50 metallic elements and minerals currently meet US and EU “critical” standards. Because of their role in building the infrastructure needed to reduce carbon emissions from climate change, some are also used in semiconductors for civilian and military communications.

● Lithium, graphite, cobalt, nickel and manganese — mainly used in electric vehicle batteries

● Silicon and tin — electric vehicles, smart grids, electricity meters and other electronics

● Rare earths — turbine magnets, electric vehicles

● Copper — power grids, wind farms, electric vehicles

● Gallium and germanium — solar panels, electric vehicles, wireless base stations, defense radars, weapons targeting systems, lasers

Positions and funds

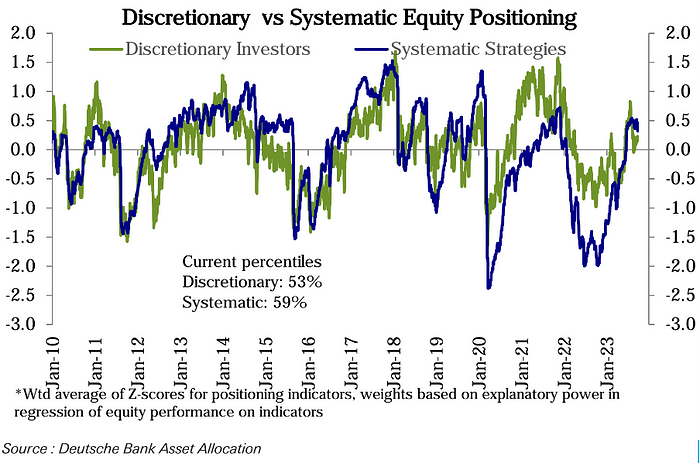

There was almost no change in subjective investor positions last week (maintaining the historical percentile of 53), while systematic strategic positions dropped significantly (percentile of 72➡️59):

The overall US stock position fell slightly by 61➡️59, entering the neutral range:

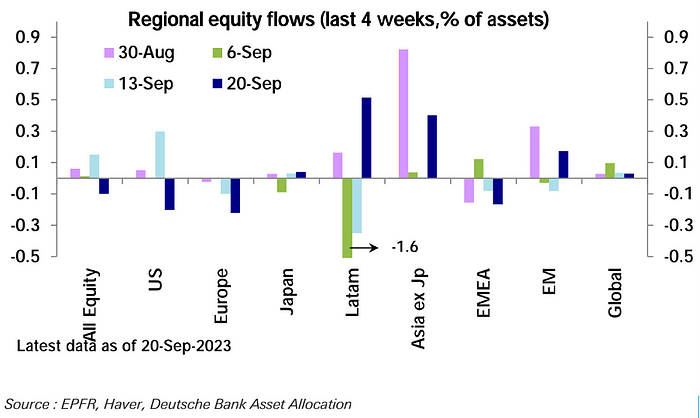

Large net outflows from equity funds last week ($16.9 billion) almost offset the previous week’s high 18-month inflows. The United States (-17.9 billion U.S. dollars) experienced the largest weekly net outflow of the year, and Europe (3.1 billion U.S. dollars) also surged to a 6-week high, continuing its 28th week of net outflows. Emerging markets ($2.6 billion) turned to net inflows after two weeks of net outflows, with Latin American and Japanese equities also seeing net inflows. However, data from the Japanese Ministry of Finance showed that foreign investors sold a net 1.58 trillion yen (approximately US$10.7 billion) of Japanese stocks last week, almost double the previous week and setting a record since March 2019.

Net inflows into bond funds this week ($2.5 billion) slowed from the previous two weeks, while emerging market debt (-$1.4 billion) saw outflows. Money market funds saw small net outflows this week (-$4.3 billion), following strong inflows in the previous two weeks. The United States (-$7.2 billion) led outflows, while Japan (-$200 million) also experienced small outflows.

By sector, technology (US$1.3 billion) continued to see inflows, and energy (US$800 million) also saw significant inflows. Financial outflows ($1.4 billion) accelerated and have been flowing out for 8 consecutive weeks. Healthcare ($500 million) and real estate ($400 million) also saw outflows, with smaller flows in other sectors.

Looking at position levels by sector, only technology (z value 0.30, 67th percentile) is still the only sector that is slightly overweighted, but only slightly above the neutral level. Consumer staples (z-score 0.15, 61st percentile) has been trimmed to neutral, similar to discretionary spending (z-score 0.01, 66th percentile). Industrials (z-value -0.08, 57th percentile) and energy (z-value -0.08, 62nd percentile) are slightly below neutral. Information technology (z-value -0.33, 48th percentile), health care (z-value -0.44, 35th percentile) and raw materials (z-value -0.47, 36th percentile) remain significantly underweight, while real estate (z-score -0.67, 16th percentile), Financials (z-score -0.75, 16th percentile) and Utilities (z-score -0.76, 16th percentile) are even more empty.

In futures markets, S&P net longs edged lower, while Nasdaq net longs jumped to their highest level since May:

That sent the overall position level in the U.S. stock futures market to its highest level since early last year, but most of that is due to the fact that this data is only as of Tuesday and does not include post-FOMC data, a figure that lifted speculators’ tendency to bet on a market rally ahead of the meeting, but it turns out they were wrong, and that data is expected to fall sharply in the next update:

Market Sentiment

The AAII Investor Survey fell to 31.3% bearish last week, the lowest since June 1, with bearish and neutral views close to around 34%:

The CNN Fear and Greed Index fell to 35.9 the lowest level since March:

Goldman Sachs’ Institutional Sentiment Indicator jumped sharply, falling from an excessive range of 1.2 to a neutral range of 0.2, corroborating with Deutsche Bank’s statistical indicator to show a significant reduction in institutional positions:

Bank of America Merrill Lynch’s bull/bear indicator retreated last week from 3.6 to 3.4:

The Week Ahead

We are in the week between the FOMC meeting and the next non-farm payrolls report.

The data focus is on the Fed’s favorite inflation gauge — the US core PCE price index for August, US durable goods orders for August, final US real GDP for Q2, China’s PMI data for September, Chinese industrial profits for August year-on-year, and Eurozone CPI inflation data.

On the central bank front Fed Chairman Jerome Powell will attend the meeting and answer questions, and the Bank of Japan releases minutes from its July monetary policy meeting.

On the government front focus on the U.S. government shutdown. Nearly 4 million (2 million military) U.S. federal employees will feel its effects immediately. Essential staff will continue to work, but others will be temporarily furloughed until the shutdown ends. No payments will be made during the impasse.

With the average annual income of $55,000 to $65,000 for USGCRP members and $45,000 for temporary workers, this could put a financial strain on these individuals.

Additionally, if the government shuts down, the U.S. Bureau of Labor Statistics has said it will stop releasing data, including key figures on inflation and unemployment. The lack of important government data would make it difficult for investors and the Federal Reserve to interpret the U.S. economy.

Goldman Sachs estimates that a government shutdown lasting a week would reduce economic growth by 0.2 percent, but that growth would rebound after the government reopens.

Hardline Republicans say any temporary spending bill is a non-starter for them. They are pushing for a government shutdown until Congress negotiates all 12 bills that fund the government, a historically daunting task, with an optimistic scenario for resolution by December.

The End.

Join us:

Github| Medium| Telegram| Twitter | Website |Discord | YouTube