Duet Protocol Global Market Recap and Outlook — 20230904

Key Points

- Over the past week, stocks from developed countries and China, gold, and short-term bonds all rose due to weak employment data supporting the sentiment for a peak in interest rates; only long-term bonds and cryptocurrencies fell.

- Long-term bonds surged on Friday for no apparent reason, with room to run in both directions with short-term bonds, posing potential future pressures.

- E-commerce companies such as Alibaba and Pinduoduo generally performed better than expected, indicating that latent demand might gather momentum and support the initial recovery of the Chinese stock market.

- China’s PMI unexpectedly surged to a 6-month high, showing that stimulus policies have taken effect.

- The positive news about Grayscale’s lawsuit win isn’t substantive since the SEC can appeal again and reject for other reasons. The next window is mid-October. Still, thanks to the optimistic sentiment in the U.S. stock market, GBTC rose by 6% for the entire week, ETHE +2.4%, and COIN +4.6%, performing much better than the crypto spot market. Investing in these assets can yield a better risk-return ratio.

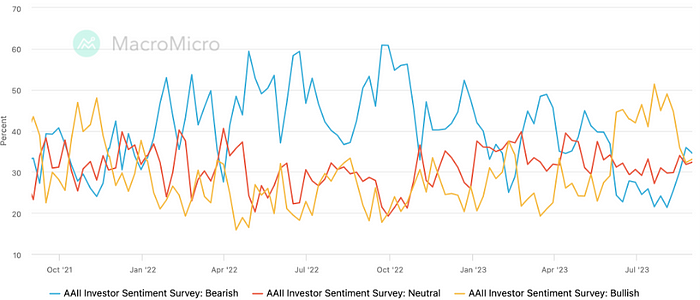

- AAII and CNN’s investor sentiment indicators have slightly turned optimistic; Deutsche Bank’s subjective investor statistics increased their positions last week, while systematic investors reduced theirs.

— -

**Overview:**

Last week was a delightful one for most global investors. Not just in developed countries, the Hang Seng and mainland China stocks, which had recently been sluggish, rebounded. The S&P 500 index rose 2.5% last week, rising four out of the five trading days, marking its best weekly performance since mid-June, bolstered by data indicating an economic slowdown. This strengthened bets on the Fed possibly delaying further rate hikes.

Moreover, the tech-heavy Nasdaq 100 soared by 3.8%, and the Russell 2000 index was up 3.6%. The U.S. dollar fluctuated but remained stable throughout the week. Gold, suppressed by the dollar and interest rates, rebounded for the second consecutive week, up by 1.3%. WTI crude oil jumped by 7.8%, primarily driven by Russia agreeing to further cuts with OPEC and U.S. oil inventories continuously declining to their lowest since the end of last year.

The S&P 500 sector performance was distinctly aggressive, with technology and energy being the strongest, and utilities and consumer staples the weakest.

However, cryptocurrencies, as we previously observed, had a weak macroeconomic response. Even last week, with favorable macro winds, the trend continued to decline. Bitcoin fell by 1%, and Ethereum by 1.4%. This divergence needs some industry-specific positives to reverse. For example, when Grayscale’s lawsuit victory increased the likelihood of an ETF coming to fruition, the market initially showed willingness to fix valuations. However, this good news wasn’t substantial enough, as the SEC could continue to appeal or reject for other reasons, ending in an inconclusive market situation.

The most crucial macro data includes:

On Tuesday, JOLTS job openings dropped to a 2-year low, and on Friday, the non-farm employment report showed an increase in unemployment. Market participants were buoyed by these figures, indicating that the overheated labor market is finally showing signs of fatigue. The aggressive tightening actions of the Federal Reserve are becoming apparent. The market hopes these reports will be enough to persuade the Fed to stop raising interest rates (though initial jobless claims have declined for the third consecutive week).

Many wonder why, despite non-farm employment numbers exceeding expectations, the unemployment rate still rose. This situation has occurred more than once this year, primarily because the total size of the employed workforce has increased (related to the exhaustion of savings). Accordingly, both the labor participation rate and working hours are growing. Although wage growth has slowed, considering the increase in working hours, the total income is still growing at a certain level, so it has not had a negative impact on the economy yet.

Other significant but limited impact data includes:

July’s core PCE price index increased by 0.22% month-on-month, marking the smallest consecutive rise in over two years. After adjusting for inflation, consumer spending further grew by 0.6% month-on-month. However, the real disposable income that supports consumer spending decreased by 0.2% month-on-month, and the personal savings rate dropped to 3.5%, indicating that the recent pace of expenditure might not continue in the coming months.

The U.S. manufacturing sector improved in August: The Standard & Poor’s manufacturing PMI final value was 47.9 vs. the preliminary value of 47.0, and the ISM manufacturing PMI was 47.6 vs. an expected 47.0. The manufacturing sector has been contracting for some time but has seen some recovery in recent months. However, we suspect this survey will deteriorate again in the coming months as it appears a car workers’ strike is imminent.

Globally, the PMI for manufacturing improved in August, but there’s a significant difference in PMI levels across countries. Overall, emerging market countries performed better than developed countries. Among developed countries, North America and Japan outperformed Europe.

### Strong Dollar and Yields

The US dollar strengthened throughout August, with the DXY index rising about 2.2% in August, peaking when Powell delivered his Jackson Hole speech on August 25th, retreating in the last week of August after four weeks of gains. The dollar’s moves are highly correlated with market rates, with 2-year yields approaching their 2022 highs last week, briefly rising above 5.1%, but then plunging over 25 basis points in the last three days of August, coinciding with the shift in futures pricing that confirms the market has almost completely priced out the chance of a September hike, mainly due to the volatility from August jobs data (led by JOLTS).

The BRICS countries held a meeting in August to discuss a gold-backed currency or trade settlement token to reduce dollar dependence, but there were no substantive results. Ironically, while de-dollarization was widely discussed, the dollar’s weight rose further. This is evidenced not only by the exchange rate strength, but also by its usage in SWIFT payments, hitting a record high of 46% in July. The increased share of the dollar came mainly at the expense of the euro, whose share fell to just below 25%, a record low. The yuan’s share was slightly above 3%.

On Friday, long-dated Treasury yields staged a V-shaped reversal, rising sharply into the close and erasing all of the declines over the previous three days. Stocks took this calmly, while gold and Bitcoin were clearly more affected, with BTC plunging from 26,000 to 25,400 concurrently as gold dropped from 1,950 to 1,936.

Given the dovish data that day, it is hard to explain why bonds were dumped, but the trend is notable. Currently, the long-short inversion remains severe, leaving ample room for long-short yields to converge sharply in either direction. If short-end yields fall faster absent a crisis, it would be welcomed by markets. But if long-end yields rise faster, markets will likely come under pressure for a period.

In the first half of August, long-dated bonds led the surge higher in risk-free rates, while short-dated yields played catch up over August 22–28, prompting long bonds to pull back. On the yield strength, economic activity exceeding expectations, surging supply, and Fitch’s US downgrade were triggers, but fundamentally, the irrational long-short yield inversion over the past year+ needed correcting.

Some argue the BoJ’s yield curve control tweak in late July was responsible for the global bond rout in early August. However, Japan’s weekly portfolio investment flow data shows Japanese investors have been consistently buying foreign bonds. In fact, they have been net buyers for most weeks since the 10Y JGB yield cap doubled from 0.25% to 0.50% in December 2021. Below is the weekly net foreign bond investment flow by Japanese investors over the past two years (in 100 million JPY):

There are also rumors that China’s FX intervention has pressured US Treasuries, which is possible, but hard to ascertain for August currently given the data lag:

### China Stabilizes

Concerns over China’s debt, especially in real estate, was a key macro theme in August, but with almost daily new stimulus measures unveiled over the past two weeks, including the first cut in stock transaction taxes since 2008 and lower mortgage rates, panic selling seems to have abated judging from the currency and stock moves. China’s NASDAQ Golden Dragon index surged 7.4% last week, Hang Seng rose 1.9%, and the CSI 300 nominally fell 3% mainly because Monday opened much higher, so +2.2% from last Friday’s close. The yuan fluctuated narrowly below the 7.3 line last week.

Apart from real estate which likely bottomed in July, China’s tech and consumer stocks have shown resilience amid earnings season.

E-commerce firms like Alibaba and Pinduoduo widely beat expectations as they capitalized on pent-up demand after COVID restrictions were scrapped. Massive spending on dining, travel, and movies has boosted optimism, with comments that following a raft of government measures to buoy markets, latent demand could build momentum and support an initial rebound in Chinese equities.

Additionally, August Caixin manufacturing PMI unexpectedly hit a 6-month high and returned to expansion territory last week, providing further evidence that targeted economic stimulus is taking some effect, and factory gloom may be nearing an end. Construction improvement was also notable, with analysts pointing to local government special bond issuance and financing platform bond offer accelerating recently, lifting public infrastructure investment.

The CSI 300 currently trades at 11.8x P/E, in the 29.7 percentile of its range over the past decade, indicating cheap relative valuation:

US Commerce Secretary Gina Raimondo met with Chinese officials last week. She was the fourth senior US official to visit China this summer, and said the trip contributed to building open lines of communication. She claimed the US does not seek to decouple from China’s economy or impede its growth, while also emphasizing export controls are for national security. Overall both sides showed some conciliation and goodwill, a cautiously optimistic result.

### Grayscale Wins But Not Really

Grayscale won a federal court ruling that the SEC must rescind its rejection of Grayscale’s request to convert the Grayscale Bitcoin Trust into a Bitcoin Exchange Traded Fund (ETF), which the SEC previously denied by arguing the product failed to meet requirements to prevent fraud and protect investors.

Grayscale Bitcoin Trust’s share price surged 19% on the news, while Coinbase stock jumped 15%. But we commented then that the boost was not substantive, as the SEC can still appeal or reject with different reasoning.

And as expected, when the SEC delayed decisions Thursday on all pending spot bitcoin ETF applications including from BlackRock and Fidelity, BTC and ETH promptly plunged, giving back all gains from earlier last week (although we don’t believe the two events are tightly linked, as Grayscale’s ETF conversion differs from new product filings by other asset managers).

A former SEC Chairman said spot bitcoin ETF approval is “inevitable” despite delays.

After that, Bitwise withdrew its application for a market cap weighted bitcoin and ether ETF in a surprise move. The application was originally filed with the SEC on August 3rd, and Bitwise’s pullback adds a bit of uncertainty to the spot ETF outlook.

But benefiting from upbeat US stock market sentiment last week, GBTC still booked a 6% gain for the week, ETHE +2.4%, COIN +4.6%, far outperforming crypto spot markets, showing the superior risk-reward of investing in these crypto-linked public equities.

Last week’s price action was almost like a mini repeat of mid-June, when BlackRock unexpectedly filed for a spot bitcoin ETF with the SEC, around the time bitcoin traded near $25,000. Over the subsequent few weeks, the price rallied more than 20% but with delays dragging out amid rising market rates and waning overall crypto interest, prices plunged back in mid-August to pre-BlackRock filing levels.

Upcoming dates to watch: After last week’s delay, the SEC now has 45 more days to respond again to the filings, meaning a reply by mid-October at the latest, but still likely no hopes up.

Also the likely launch of Ethereum futures ETFs in early October, with around a dozen firms including Volatility Shares, Bitwise, Roundhill, and ProShares having filed for products tracking ETH futures, and sources suggesting regulators are unlikely to block these.

Fund Flows and Positioning Changes

Last week saw renewed interest in equity funds, particularly in the US and emerging markets, as well as the tech sector; discretionary investors added exposure while systematic strategies trimmed positions.

According to Deutsche Bank’s metrics, discretionary investor exposure in US stocks plunged from late July to slightly below neutral before rebounding slightly last week back above neutral, currently at the 53rd historical percentile. Meanwhile, systematic strategy exposure kept rising since mid-June until pulling back over the past two weeks, now at the 61st historical percentile.

Equity funds saw the largest weekly inflow in 5 weeks at +$10.3 billion, mainly from the US at +$4.5 billion and emerging markets at +$4.9 billion. Bond funds took in +$1.7 billion, a slight increase over the past two weeks. Money market funds had $6.5 billion of inflows, with the US at +$10.7 billion while Europe saw -$4.5 billion out:

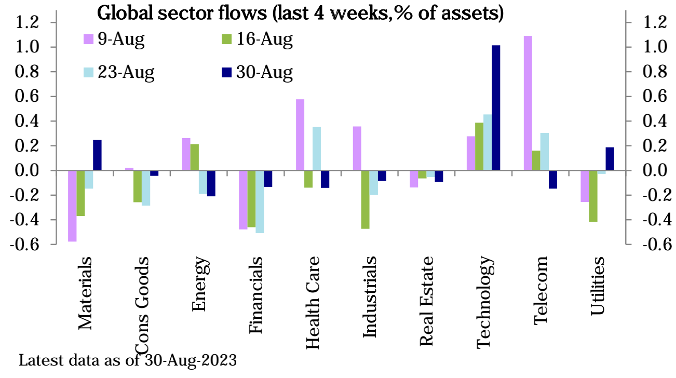

Among equity sectors, tech funds saw the biggest inflows while energy funds saw the largest outflows despite rising oil prices:

CFTC data shows overall net longs in US equities were unchanged last week, mainly on reduced S&P 500 net longs offset by increased Nasdaq 100 net longs, while Russell 2000 and Dow net shorts also declined. Outside the US, emerging market net longs decreased slightly, possibly reflecting investor caution towards EM.

In FX, dollar net shorts declined, potentially indicating increased optimism on the dollar. In commodities, oil net longs were flat, gold and silver net longs rose, while copper net shorts fell:

Investor Sentiment Indicators:

The AAII survey bull/bear mix showed little change last week, with sentiment turning slightly more bullish:

The CNN Fear & Greed Index rebounded from 48 to 56, entering positive territory:

Stablecoin Flows

Total on-chain stablecoin supply increased substantially for the second straight week (+$660 million), the first back-to-back weekly growth since February this year, mainly attributable to TUSD issuance:

Exchange stablecoin balances declined for the second consecutive week (-$118 million), the largest outflow in four weeks:

Future Focus Points:

With Monday being a US holiday for Labor Day and limited important data this week, below are some medium-term outlooks.

COVID-era savings are declining, the labor market is cooling, delinquencies are rising, student loan interest will resume accruing in October, which could dampen consumer momentum after September, so far data shows robust US consumer rebound this summer. Some retail firms also expressed similar concerns during the recent earnings season, remaining cautious on the outlook.

On student loans, Goldman estimates the full resumption of payments will amount to about $70 billion, or around 0.3% of disposable personal income, which will subtract 0.8 percentage points from Q4 PCE (personal consumption expenditure) growth. The impact could be muted as some borrowers may not immediately resume payments, and some may qualify for benefits under the Biden administration’s recently announced income-based repayment plan.

Debate over the US budget is again in focus as spending authorization is needed before the new fiscal year starts October 1st, and partisan disagreement remains high with almost no progress on this issue. In addition, authorization expires in September for many programs including expanded unemployment benefits. Unlike the debt ceiling fight which threatens technical default, failure to grant spending authorization could result in partial government shutdowns. Market commentary widely acknowledges the elevated risk of US federal government shutdowns later this year, although historically financial markets have not reacted strongly to shutdowns.

Additionally, the contract for US autoworkers’ union expires September 14th, bringing a strike threat into view.

Institutional Views

**From BlackRock to PIMCO, bond investors bet the Fed is done hiking**

Recent jobs data has bond market participants believing the Fed is unlikely to hike again soon, possibly completing hikes for this cycle. With focus shifting to when the Fed may turn dovish, short-dated bonds will outperform longer-dated. The strategy could also benefit from seasonal trends — companies typically rush to sell debt after the US Labor Day holiday, pressuring longer-dated bonds. BlackRock’s Jeff Rosenberg called it a “screaming buy.” PIMCO portfolio manager Michael Cudzil believes the hiking cycle is over, and the first cut will steepen the yield curve again.

**Morgan Stanley: Stick with late cycle defensive stance**

Michael Wilson: Over the past week, stock prices have rebounded sharply, again led by growth stocks. As weaker economic data put pressure on treasury yields, market participants seem willing to re-rate stocks higher on the view that a late cycle economic environment is extending again. In sum, price momentum is a key driver of sentiment, especially in a late cycle environment when uncertainty about outcomes is high. Given growth concerns or financial stresses can return at any time in a late cycle backdrop, we continue to recommend a more defensive stance in portfolios, especially as we enter September.

We would caution investors against getting too comfortable with the existing consensus view that economic growth is going to re-accelerate. We continue to maintain a late economic cycle mindset, meaning tilting investments to growth and defensive stocks, not cyclicals or small caps.

Heading into Q2 earnings season, we think it will be a “sell the news” event, mostly because stocks rallied sharply into mid-July. That said, outside of some key areas driven mostly by cost cutting, this year’s earnings results have not kept up with the economy, further solidifying our view that we remain late cycle.

The End.

Join us:

Github| Medium| Telegram| Twitter | Website |Discord | YouTube